Donate Stocks

Put Stock in Something that Matters!

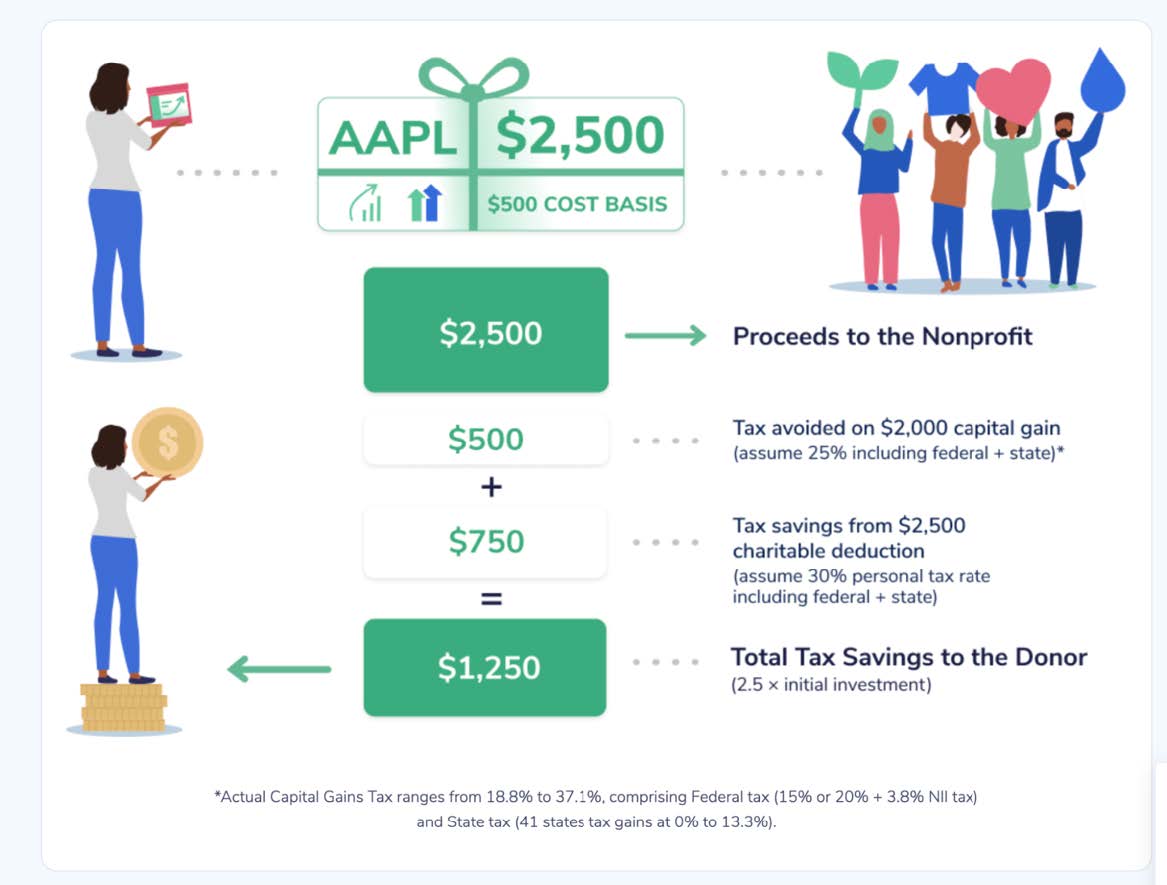

Did you know stock gifting is the most tax-friendly ways to support our mission?

When you donate stock, you may avoid the tax on the gain while deducting 100% of the value of the contribution; and, when you donate stock rather than selling it, we get to keep the proceeds that would have gone to pay taxes.

It’s a win-win for you and us!

A Bigger Impact

It’s easy to support Jamaica Relief Ministries with a tax-advantaged stock gift in minutes!

● Avoid taxes on capital gains* while deducting the fair market value of gifted stock held more than one year.

● Amplify your generosity with a pre-tax gift: let us keep the proceeds that would have been paid in taxes had you sold the stock.

● It’s fast, safe and free to donate stock!

*Capital Gains Tax and NII Tax rates range from 18.8% to 37.1%, depending on your income and state of residence.

Disclaimer: This information is provided for educational purposes only and is not intended to serve as legal, tax, or investment advice. Please consult with a professional tax advisor.

An Easy Process

Best of all, it’s fast, safe and free to donate stock to Jamaica Relief Ministries. With our Easy Button for Stock Gifting, you can donate stock in minutes at no cost. Just click below to initiate a stock gift through a secure portal.

So, remember, charitable giving doesn’t always mean cash. By gifting stock, you can have greater impact — without denting your pocketbook.

Click the button to get started.

How Does it Work?

1. What are the benefits of donating stock? We are not financial advisors but in general the benefits are:

● Avoid paying capital gains tax on appreciated securities

● Receive a charitable tax deduction for the full fair market value

● Greater impact by making a pre-tax gift

2. What are the guidelines around charitable stock gifting?

● You can donate publicly traded stocks, mutual funds, and ETFs

● You must have owned the stock for more than one year

● Stock may not be restricted

● Must be traded on a major exchange

● Deduction is limited to 30% of your adjusted gross income (AGI)

*Remember, it’s always advisable to consult with a tax professional for specific advice regarding your individual situation.

3. How does the stock gifting process work?

● Shares are transferred from the donor’s brokerage account to our account as a DTC Stock Transfer

● There’s no paperwork, calls or email required. Everything is done online in the DonateStock app.

● Like “PayPal for stock gifting” it just takes a few minutes to submit the information needed to initiate the gift

● It then takes 2-5 business days for the stock to be transferred between accounts

● You’ll be notified when the stock arrives and an acknowledgement letter will follow shortly

4. How do I get started?

● Visit our stock gifting page: jamaicarm.org/donatestock

Simply click “Donate Stock” and follow instructions as a donor

● Allow 2-5 business days for the stock to be received

5. What if I prefer to have my advisor do it for me?

● No problem, just direct your advisor to our stock gifting page: jamaicarm.org/donatestock

● Simply click “Donate Stock” and follow instructions as an Advisor.

● They can quickly obtain the information they need to initiate the gift on your behalf while providing us with the transparency we need to monitor and acknowledge the gift.

6. Is it safe?

● Yes! DonateStock was designed with security and privacy in mind and is hosted on one of the world’s most platforms. DonateStock has passed numerous security and compliance assessments from some of the country’s largest and most sophisticated organizations.

7. How much does it cost?

● There’s no cost to you or your advisor.